Simplify Your Finances: Exactly How to File Your Online Tax Obligation Return in Australia

Filing your on-line tax obligation return in Australia need not be a daunting task if come close to carefully. Understanding the ins and outs of the tax obligation system and sufficiently preparing your documents are crucial first steps.

Understanding the Tax Obligation System

To browse the Australian tax obligation system successfully, it is essential to grasp its basic principles and structure. The Australian tax system operates on a self-assessment basis, suggesting taxpayers are accountable for accurately reporting their revenue and calculating their tax obligations. The primary tax authority, the Australian Taxes Workplace (ATO), supervises compliance and implements tax laws.

The tax system comprises different parts, including income tax obligation, goods and solutions tax (GST), and capital gains tax obligation (CGT), to name a few. Specific revenue tax obligation is dynamic, with rates raising as income rises, while company tax obligation prices differ for little and huge companies. In addition, tax offsets and deductions are readily available to reduce taxed revenue, enabling for even more tailored tax responsibilities based on individual situations.

Knowledge tax residency is also vital, as it identifies a person's tax obligation obligations. Locals are strained on their around the world revenue, while non-residents are only tired on Australian-sourced earnings. Experience with these principles will equip taxpayers to make enlightened choices, making certain compliance and possibly optimizing their tax end results as they prepare to submit their on-line tax obligation returns.

Readying Your Files

Gathering the needed files is a crucial action in preparing to submit your on-line tax return in Australia. Appropriate documents not only improves the declaring procedure however likewise makes certain precision, lessening the danger of mistakes that could lead to hold-ups or penalties.

Start by gathering your income declarations, such as your PAYG payment recaps from employers, which information your revenues and tax withheld. online tax return in Australia. If you are independent, guarantee you have your business revenue records and any type of appropriate invoices. Additionally, collect financial institution declarations and paperwork for any type of passion earned

Next, compile records of insurance deductible expenses. This might include receipts for job-related expenses, such as attires, traveling, and devices, as well as any kind of educational expenses connected to your profession. Ensure you have paperwork for rental earnings and connected expenditures like repair work or residential property monitoring costs. if you possess building.

Don't neglect to include other appropriate papers, such as your medical insurance information, superannuation contributions, and any kind of financial investment revenue declarations. By thoroughly arranging these records, you establish a solid foundation for a reliable and smooth on-line income tax return process.

Choosing an Online Platform

After arranging your documentation, the next action includes picking a proper online system for filing your tax obligation return. online tax return in Australia. In Australia, several reliable platforms are offered, each offering distinct functions tailored to different taxpayer requirements

When choosing an on the internet system, take into consideration the interface and convenience of navigation. An uncomplicated style can considerably boost your experience, making it less complicated to input your details properly. Furthermore, make certain the system is certified with the Australian Taxes Office (ATO) policies, as this will assure that your entry fulfills all legal requirements.

One more critical element is the schedule of customer support. Systems using online talk, phone support, or extensive Frequently asked questions can give valuable assistance if you come across obstacles throughout the declaring process. Evaluate the security measures in location to shield your individual info. Search for systems that use security and have a solid privacy policy.

Lastly, take into consideration the expenses connected with different platforms. While some may supply complimentary services for standard income tax return, others might charge costs for sophisticated attributes or additional support. Weigh these factors to choose the platform that straightens finest with your financial situation and declaring requirements.

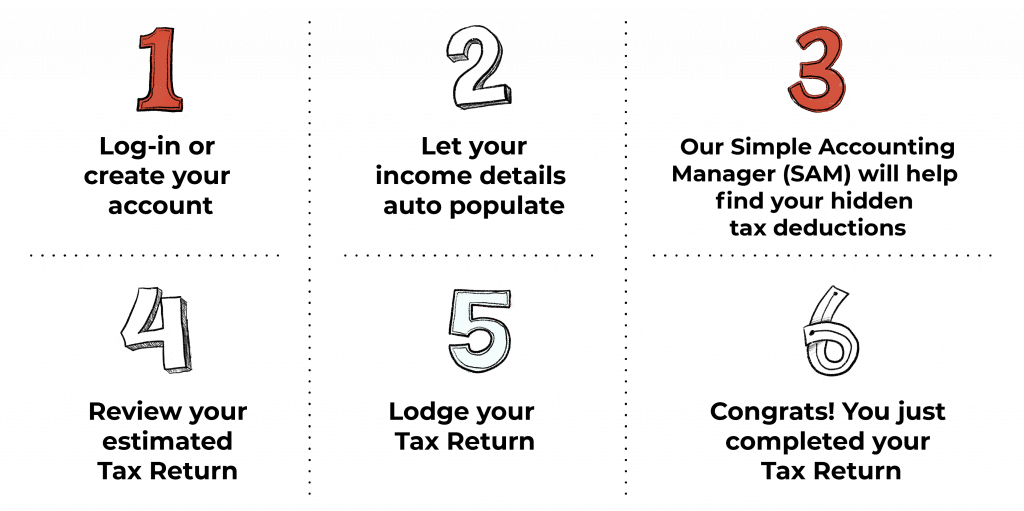

Step-by-Step Filing Procedure

The step-by-step filing procedure for your online income tax return in Australia is created to enhance the entry of your economic details while making certain compliance with ATO policies. Started by collecting all necessary files, including your revenue declarations, bank statements, and any type of invoices for reductions.

Once you have your files prepared, log in to your chosen online platform and develop or access your account. Input your personal information, including your Tax Data Number (TFN) and contact details. Next, enter your income information properly, making sure to include all incomes such as wages, rental revenue, or financial investment earnings.

After describing your revenue, proceed to declare eligible reductions. This may include job-related costs, charitable contributions, and medical costs. Make certain to examine the ATO standards to maximize your cases.

As soon as all details is entered, meticulously evaluate your return for accuracy, this hyperlink fixing any disparities. After guaranteeing whatever is right, submit your tax obligation return electronically. You will obtain a confirmation of entry; maintain this for your documents. Check your account for any type of updates from the ATO concerning your tax obligation return status.

Tips for a Smooth Experience

Completing your on the internet income tax return can be a simple process with the right prep work and attitude. To ensure a smooth experience, begin by gathering all essential papers, such as your revenue statements, invoices for reductions, and any kind of various other appropriate financial records. This organization lessens mistakes and saves time during the filing procedure.

Following, familiarize yourself with the Australian Taxation Workplace (ATO) website and its online services. Use the ATO's sources, including overviews and Frequently check my reference asked questions, to make clear any kind of unpredictabilities prior to you start. online tax return in Australia. Think about setting up a MyGov account connected to the ATO for a streamlined filing experience

In addition, capitalize on the pre-fill capability used by the ATO, which automatically inhabits a few of your information, reducing the chance of blunders. Ensure you confirm all access for accuracy prior to entry.

If problems emerge, do not wait to speak with a tax obligation expert or utilize the ATO's assistance services. Following these tips can lead to a problem-free and successful on-line tax return experience.

Verdict

In final thought, filing an on-line tax obligation return in Australia can be structured with cautious prep work and option of ideal resources. Ultimately, these methods add to an extra reliable tax declaring experience, streamlining financial management and enhancing compliance with tax obligation commitments.